The Complex Web of Economic Dynamics

Living in Addis Ababa has its own unique charm, but it's impossible to overlook the glaring question many of us face: why does everything seem so expensive here? The cost of living in Ethiopia can feel steep, and understanding the reasons behind this requires a deep dive into the country's economic underpinnings. Various factors play into this scenario, including the currency's devaluation, reliance on imports, and inflation rates that often seem to spiral out of control.

One prime factor that hits the wallet hard is the Ethiopian Birr's devaluation against foreign currencies. This isn't just numbers on a financial chart; it directly impacts everyday life. When the Birr loses value, the cost of importing goods—which constitutes a significant portion of what's available in the market—skyrockets. Everything from electronics to basic food items gets marked up, reflecting the increased cost to bring these goods into the country. But it's not just about imports. Ethiopia's own economic growth, although robust in some sectors, hasn't equally translated into affordable living conditions for its residents.

In discussing inflation, it's essential to look beyond the immediate price tags. The inflation rate in Ethiopia has been in the double digits for several years, gnawing away at purchasing power. It means that even if wages increase, the cost of living outpaces income growth, making it challenging to keep up with expenses. This phenomenon isn't just about economic numbers; it represents a real struggle for families trying to maintain a standard of living.

Moreover, government policies and interventions, while often designed to stabilize the economy, can have unintended consequences. Taxation on imports, for example, is a double-edged sword. While it's aimed at protecting local industries and generating revenue, it also adds another layer of cost to goods that consumers need. Understanding these policies is crucial for anyone trying to navigate the economic landscape of Ethiopia.

Living Under the Shadow of Import Reliance

The shadow of import reliance looms large over Ethiopia. The reality is, from medical supplies to luxury goods, the country depends significantly on the outside world for its needs. This dependency is a key driver of the high cost of living. For businesses importing goods, each step in the logistics chain, tangled with bureaucracy and taxation, adds to the final price tag that consumers face.

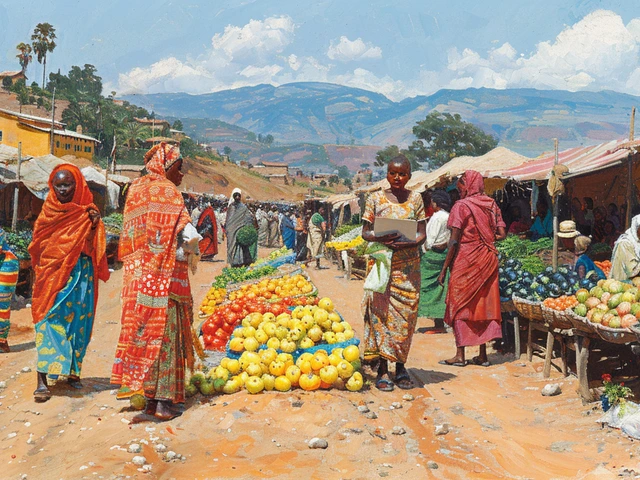

Another aspect to ponder is the agricultural sector, which, despite being the backbone of Ethiopia's economy, is yet to reach its full potential in terms of production and export. The result is a paradox where a country rich in agricultural resources ends up importing food. Efforts to modernize farming practices and infrastructure are ongoing, but the pace of change is slow, and the impact on prices at the local markets is yet tangible.

The reliance on imports also makes Ethiopia vulnerable to global market fluctuations. A spike in oil prices, for instance, doesn't just mean more expensive fuel at the pump; it cascades through the economy, affecting everything from transportation costs to the price of plastics. This global interconnectivity means that even events far from Ethiopia's borders can have a direct impact on the wallet of its citizens.

Strategies to Navigate the High Cost of Living

Navigating the high cost of living in Ethiopia requires a blend of practical strategies and a deep understanding of the local economic context. One piece of advice is to focus on local products. Supporting local businesses not only helps the economy but can also be a cost-saving measure, as local products are often less subject to the whims of currency fluctuations and import taxes.

Another strategy is to stay informed about governmental policies and subsidies that may affect the cost of essentials like food and fuel. Awareness of these changes can help in planning expenses more effectively. Additionally, community-based initiatives, such as cooperative buying groups, can leverage collective bargaining to secure lower prices for basic goods.

Perhaps most importantly, financial literacy is crucial. Understanding how to manage personal finances, from budgeting to investing, can mitigate the impact of inflation and help in building a buffer against the economic shocks that seem all too common. While the challenges of living in Ethiopia are real, so too are the opportunities for those prepared to navigate its complex economic terrain.

Why Ethiopia is Thriving: Unveiling the Secrets Behind Its Success

Why Ethiopia is Thriving: Unveiling the Secrets Behind Its Success

Living Conditions and Housing Types in Ethiopia

Living Conditions and Housing Types in Ethiopia

Unveiling Ethiopia's Poorest City: Understanding Dire Circumstances

Unveiling Ethiopia's Poorest City: Understanding Dire Circumstances

Understanding the Average Income in Ethiopia Measured in US Dollars

Understanding the Average Income in Ethiopia Measured in US Dollars

Understanding Average Income Levels in Ethiopia: Analysis in USD

Understanding Average Income Levels in Ethiopia: Analysis in USD

Larry Keaton

April 4, 2024 AT 01:07Hey folks, just wanted to share a couple of practical tips for dealing with the birr’s roller‑coaster ride. First off, shop at local markets whenever you can – they’re usually less hit by import taxes and you’re supporting Ethiopian farmers. Second, keep an eye on the government’s subsidy announcements; they sometimes roll out short‑term price caps on essentials. And don’t forget to negotiate – many shop owners will give you a discount if you buy in bulk or pay cash. Lastly, consider forming a small buying group with neighbors – you can pool resources and order directly from producers, cutting out the middle‑men fees. Stay flexible, stay informed, and you’ll find ways to stretch that hard‑earned money a bit farther.

Liliana Carranza

April 4, 2024 AT 12:14What a whirlwind of factors, right? 🌍 The devaluation of the birr really does feel like a never‑ending tide, pulling everything up in price. I love how you pointed out the hidden cost of import taxes – most people just see the sticker price and wonder where the extra dollars went. One bright spot is the push for more local agro‑industry; if the government can boost processing plants, we might see cheaper food on the shelves. In the meantime, keep an eye on community co‑ops – they’re a fantastic way to get fresh produce without the import markup. And remember, knowledge is power: staying up‑to‑date on policy changes can give you a leg up on budgeting for the month.

Jeff Byrd

April 4, 2024 AT 23:20Alright, buckle up because we need to unpack this mess thoroughly. First, the birr’s devaluation isn’t just a number on a chart; it literally turns your paycheck into a fraction of its former self, making every imported item feel like a luxury. Second, the reliance on imports is a structural issue – without a robust domestic manufacturing base, the country is forced to import almost everything, from electronics to basic staples, which adds layers of cost at each customs checkpoint. Third, inflation in double digits eats away at real wages, meaning even if salaries rise modestly, purchasing power still declines. Fourth, government tax policies, while intended to protect local industry, often double‑dip by levying both import duties and value‑added taxes, inflating final prices. Fifth, logistical bottlenecks – inefficient port handling, bureaucratic delays, and inadequate infrastructure – increase transport costs, which are ultimately passed on to consumers. Sixth, the agricultural sector, despite being the backbone of the economy, suffers from low productivity and limited access to modern technology, forcing the nation to import food that it could otherwise produce. Seventh, global commodity price swings, especially in oil, cascade through the economy, raising fuel prices, which then affect transportation and, consequently, the price of goods. Eighth, currency volatility discourages foreign investment in local manufacturing, perpetuating the import‑dependence cycle. Ninth, the informal sector often operates outside price controls, creating a shadow market where prices can be even higher. Tenth, subsidies are inconsistently applied, sometimes benefiting only select groups while leaving the average consumer bearing the brunt. Eleventh, the lack of price transparency makes it hard for consumers to compare options, leading to market inefficiencies. Twelfth, social safety nets are limited, so low‑income households bear a disproportionate share of the burden. Thirteenth, the education system doesn’t sufficiently equip the workforce with skills needed for a diversified industrial base. Fourteenth, regional disparities mean that urban centers like Addis Ababa feel the pinch more sharply than rural areas where informal economies dominate. Fifteenth, political instability at times leads to sudden policy shifts that can destabilize markets overnight. Lastly, all these factors together create a feedback loop where high costs deter domestic production, forcing more imports, which in turn keep costs high. In short, it’s a complex web, and untangling it will require coordinated reforms across fiscal policy, infrastructure investment, agricultural modernization, and monetary stability.

Crystal Novotny

April 5, 2024 AT 10:27Interesting points, but the whole "import tax" narrative is overstated. The market adjusts quickly, and many retailers absorb part of the cost to stay competitive. Moreover, focusing solely on devaluation ignores the fact that local producers still dominate food supplies. The article could have highlighted that grassroots initiatives already mitigate some price pressures.

Joel Watson

April 5, 2024 AT 21:34The discourse surrounding Ethiopia's cost of living is undeniably nuanced, yet the prevailing analysis tends to conflate macroeconomic variables with quotidian consumer experiences. While the devaluation of the birr undeniably exerts upward pressure on import‑dependent commodities, one must also consider the structural inefficiencies endemic to the supply chain, from port logistics to intra‑national distribution networks. Furthermore, the fiscal architecture, characterized by layered taxation, warrants a more granular examination to discern its proportional impact on disparate socioeconomic strata. In sum, a holistic appraisal necessitates integrating both quantitative indicators and qualitative lived realities.

Chirag P

April 6, 2024 AT 08:40From my perspective, the emphasis on currency devaluation should be balanced with the strides Ethiopia is making in agricultural reform. The government’s recent initiatives to provide better irrigation and seed distribution are gradually reducing reliance on food imports. While challenges remain, it’s important to acknowledge progress alongside the obstacles.

RUBEN INGA NUÑEZ

April 6, 2024 AT 19:47Respectfully, the optimism about agricultural reforms must be tempered with hard data. Production indices have risen only marginally, and many smallholder farms still lack access to credit and modern equipment. Until we see measurable increases in yield that can replace imports, the cost‑of‑living pressure will persist.

Michelle Warren

April 7, 2024 AT 06:54Wow, this is just too much information.

Christopher Boles

April 7, 2024 AT 18:00Totally get the overload feeling. Maybe just focus on a couple of easy wins: buy local, join a buying group, and keep an eye on subsidy news. Small steps can add up.

Reagan Traphagen

April 8, 2024 AT 05:07Everyone’s talking about inflation, but nobody mentions the hidden agenda behind the currency manipulation. The elite financiers are pulling strings to keep the birr weak, ensuring their overseas assets stay valuable. It’s a classic case of financial engineering at the expense of ordinary citizens.

mark sweeney

April 8, 2024 AT 16:14Sure, blame the financiers, but that’s just a convenient scapegoat. Policies are more complex, and the government’s own missteps-like over‑regulating imports-play a huge role. Not everything is a grand conspiracy.

randy mcgrath

April 9, 2024 AT 03:20Thinking about the cost of living invites a broader philosophical question: what does “affordability” truly mean in a society? If we measure well‑being merely by purchasing power, we miss the richer dimensions of community support, cultural resilience, and social cohesion that can offset material scarcity.

Frankie Mobley

April 9, 2024 AT 14:27That’s a solid point. In practice, though, people need concrete tools: budgeting templates, lists of reliable local vendors, and tips for reducing energy use. Philosophy is nice, but actionable advice wins the day.

ashli john

April 10, 2024 AT 01:34Reading through all this, I’m reminded how important it is to stay curious and keep asking questions. Why does a single policy change ripple through households? How can we build better community networks to share resources? Let’s keep digging and not settle for surface‑level answers.

Kim Chase

April 10, 2024 AT 12:40Totally agree! And hey, maybe we can start a subreddit thread where locals share tips on cheap eats, free events, and DIY repairs. Small collective actions can create big savings.

David Werner

April 10, 2024 AT 23:47Everyone’s talking about market forces, but nobody mentions how global oil cartels manipulate fuel prices to keep nations like Ethiopia dependent. The price spikes we see are not accidental – they’re engineered to destabilize economies and keep populations compliant.

Paul KEIL

April 11, 2024 AT 10:54Let’s not get lost in jargon about “cartels” without solid evidence. The more productive route is to improve energy efficiency, diversify energy sources, and lobby for transparent pricing. Over‑theorizing distracts from tangible solutions.

Horace Wormely

April 11, 2024 AT 22:00Grammar note: “devaluation” is a noun, not “devaluating”. Also, avoid using “gotta” in formal analysis; prefer “must”. Consistency improves readability.

christine mae cotejo

April 12, 2024 AT 09:07While we dissect the economic anatomy of Ethiopia’s cost‑of‑living crisis, it is crucial to remember that data alone does not tell the whole story. The lived experience of families navigating daily markets, coping with rising prices, and finding joy in community gatherings is an essential element of any comprehensive analysis. By weaving together quantitative indicators-such as inflation rates, exchange‑rate fluctuations, and import tariffs-with qualitative narratives about resilience, adaptation, and hope, we can formulate policies that are both effective and humane. In practice, this means supporting local producers through micro‑finance, streamlining customs procedures to reduce hidden costs, and expanding public awareness campaigns that empower citizens with budgeting tools. It also calls for a balanced approach that recognizes the inevitable influence of global commodity markets while striving to insulate vulnerable households through targeted subsidies and price caps on essential goods. Ultimately, the goal is not merely to lower numbers on a spreadsheet but to enhance the overall quality of life for Ethiopians, ensuring that progress is measured in smiles, health, and the ability to envision a brighter future.